Your credit score plays a vital role in your financial life. It impacts everything from loan interest rates to rental applications and even employment decisions. That’s why it’s so important to understand what goes into your score and take steps to build the best credit possible.

In this comprehensive guide, we’ll cover everything you need to know about credit scores, from what they are to specific ways you can improve yours quickly. You’ll also find a detailed comparison of the most popular credit scoring models. Building an Excellent Credit Score

What Is a Credit Score and Why Does It Matter?

A credit score is a three-digit number usually between 300 and 850 that is calculated based on information in your credit report. It’s a snapshot of your credit health that lenders, landlords, insurance companies and even some employers use to determine how financially reliable or risky you are.

The most common credit scores used by lenders are:

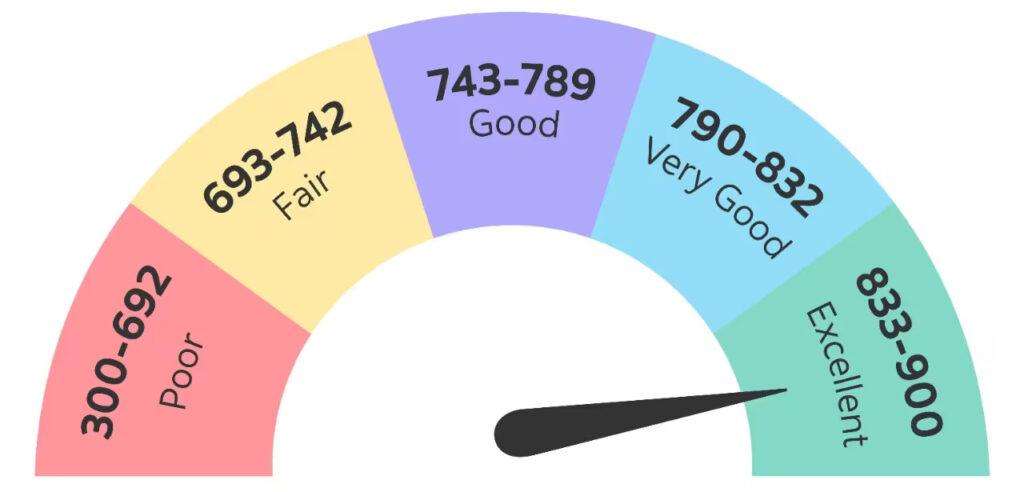

- FICO Score – The most widely used credit score model created by the Fair Isaac Corporation. FICO scores range from 300 to 850.

- VantageScore – A credit score model created collaboratively by the three major credit bureaus as an alternative to the FICO score. Vantage scores also range from 300 to 850.

In general, the higher your credit score, the better. Higher scores signify to lenders that you are a lower credit risk and more likely to repay debt obligations. As a result, you can qualify for better interest rates, lower insurance premiums, and more ideal rental housing.

On the other hand, a lower score translates into higher perceived risk and therefore worse terms on financial products. For instance, someone with a credit score below 620 may not qualify for a traditional mortgage at all with a mainstream lender. Poor credit can hamper your finances and make things like financing a car very expensive.

That’s why monitoring and improving your credit should be a financial priority. Even a small score improvement can save thousands on a home, auto or credit card.

How Credit Scores Are Calculated (Building an Excellent Credit Score)

Credit scores consider five main factors from your credit history to determine your three-digit number:

1. Payment History

Whether or not you’ve paid debts on time. This category makes up a substantial 35% of a FICO score. Late payments can lower scores significantly, especially if a debt has been handed to collections agencies.

2. Credit Utilization

The ratio between current revolving (credit card) debt and total available revolving credit. For example, if you have $2,000 in credit card balances and $10,000 in total credit limits across all cards, your credit utilization ratio is 20%. Lower ratios are better for your score.

3. Length of Credit History

How long you’ve had access to credit and been managing it responsibly. Consumers with longer established credit histories tend to have higher scores.

4. Credit Mix

The variety of credit types in your profile, including credit cards, retail accounts, installment loans and mortgages. A healthy mix of different credit across your profile can help build robust credit.

5. New Credit

How frequently you open new accounts, number of recent credit inquiries and more. For instance, applying for many new accounts in a short timeframe can lower your score.

As you can see, credit scores boil down your entire history with borrowing and repaying debt into one three-digit snapshot of your financial reputation. Consistently demonstrating you handle credit well over time helps raise that number.

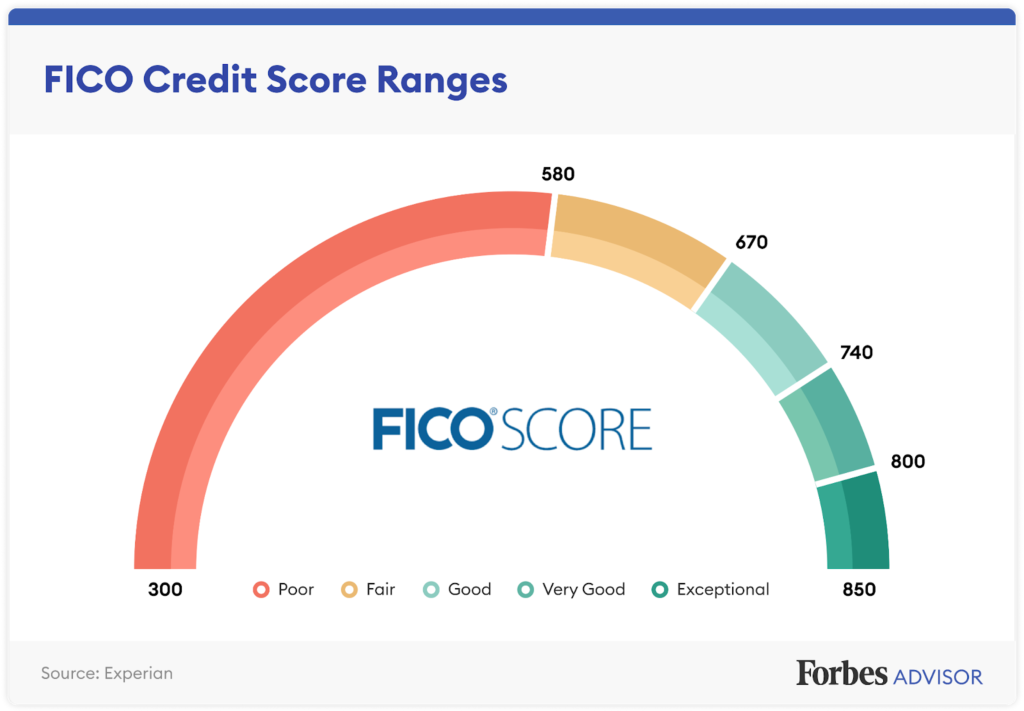

Credit Score Ranges and Impact

Not all credit scores are created equal. Your number represents a rating of your creditworthiness that lenders translate into concrete impacts like increased borrowing costs. In general terms, you can expect:

| Credit Score Range | Impact |

|---|---|

| 300-579 | Poor credit score range indicating high risk of default and increased borrowing costs. May struggle to qualify for new credit products. |

| 580-669 | Fair credit score range still considered high risk for lenders but can possibly qualify for credit products geared towards rebuilding credit history. Expect high interest rates and fees. |

| 670-739 | Good credit score range demonstrating reasonable management of debt in the past. Considered an average score by most lenders and should qualify for affordable rates. |

| 740-799 | Very good credit score range rewarded with favorable borrowing terms from most lenders. Demonstrates reliability in repaying debts. |

| 800-850 | Exceptional credit score range qualifying you for the very best rates and terms. Signals low risk and financially responsible borrower. |

As you cross major score thresholds into higher tiers, the impact on financial products becomes more pronounced. For reference, interest rates on popular credit cards for good credit vs. excellent credit can differ by nearly 10 percentage points!

The more you build credit and creep higher in the range, the better off your finances will be thanks to better loan terms.

Comparing Major Credit Scoring Models

While FICO is still the most popular credit score model used by 91% of top lenders, according to Forbes, more alternatives like VantageScore have emerged. But how exactly do these differ?

Major credit scoring models including FICO and Vantage actually share many commonalities in calculating your score including assessing the five key factors like payment history and debt management. However there are subtle differences to be aware of:

| Model | Score Range | Factors Weight | Payment History Emphasis | Credit Mix | Score Fluctuation |

|---|---|---|---|---|---|

| FICO Score | 300-850 | Payment history (35%), credit utilization (30%), length of history (15%), new credit (10%), credit mix (10%) | FICO puts heaviest emphasis on repayment history accounting for over 1/3 of score | Not a major factor but can still positively or negatively impact score | Lower score fluctuation thanks to emphasis on long history |

| VantageScore | 300-850 | Payment history (40%), age and type of credit (21%), percent credit used (20%), available credit (11%), recent credit (5%), outstanding debt (3%) | At 40% weight, payment history is most critical factor by wide margin | Explicitly considers credit mix as positive scoring factor | Responds more rapidly to changes in payment behaviors |

In comparing FICO vs. Vantage scores directly for an individual consumer, the numbers can vary significantly. According to FICO research, over 50% of consumers have a 50+ point difference between their FICO and Vantage scores.

The good news is FICO remains the dominant model used by over 90% of lenders. Focusing on steadily building your FICO score over time following the best practices below is the surefire way to save money on borrowing costs.

12 Tips to Build Excellent Credit Scores

Now that you understand exactly what goes into your score, what range to aim for and how models like FICO operate, let’s get into the meat of actually improving your credit.

Here are 12 powerful ways to start building your credit score today:

1. Review Your Credit Reports Annually

Misreporting errors can sabotage your score without you ever knowing. Make sure to check your three credit reports from Equifax, Experian and Transunion once per year to spot any inaccuracies dragging your score down. Getting errors fixed directly with the credit bureaus protects your score.

2. Pay All Bills On Time

Payment history makes up over one third of your FICO score, making this the most vital area to build credit. Set up automatic payments or payment reminders with all lenders whenever possible. Even one 30-day late payment can ding your score by over 100 points.

3. Keep Credit Card Balances Low

Ideally, try to pay off credit cards in full each month. High balances compared to limits (aka credit utilization) overwhelm 30% of your FICO Score calculation. Letting balances creep too high can significantly drag your score down over 50 points.

4. Limit New Credit Applications

Each new credit application prompts a hard inquiry on your credit report that can lower scores, especially if done frequently. Try to limit new applications to one or two per year max when rebuilding credit. Too many new accounts too fast actually raises your risk profile.

5. Build Credit History Over Time

FICO emphasizes the length of your positive credit history when calculating scores. Letting accounts age while staying in good standing with on-time payments gradually builds your score over years better than quick fix attempts ever could. Time is your ally here.

6. Diversify Credit Types

Don’t put all your credit eggs in one basket. Having credit cards, installment loans like auto financing, mortgages, student loans and more actually helps demonstrate you can handle different types of credit successfully. Mix it up to maximize scores.

7. Become an Authorized User

Ask close family members with excellent credit if they will add you as an authorized user on a long-held credit account of theirs. This lets their positive history legally count towards your credit profile and score too!

8. Dispute Errors with Credit Bureaus

If checking your credit reports reveals mistakes like incorrectly reported late payments or fraudulent accounts opened in your name, don’t hesitate to directly dispute the errors with the credit bureaus. They are legally obligated to investigate and remove inaccurate, unverifiable or incomplete information.

9. Consider Secured Credit Cards

Those rebuilding credit often struggle to qualify for unsecured credit cards and loans. Secured credit cards require a refundable security deposit that acts as your initial credit limit while you demonstrate responsible usage and timely payments. Secured card activity gets reported to the major credit bureaus to start accruing positive history.

10. Maintain Low Debt-to-Income

Lenders approve credit applications not just based on your credit score or history but also your existing debt load. Maintain a low debt-to-income ratio (ideally under 36%) by limiting borrowing to help qualify for new credit necessary to round out your mix.

11. Check Credit Score Frequently

You can’t improve what you can’t measure. Checking your scores frequently (the average FICO score for free) using sites like Credit Karma reveals whether your credit building tactics are actually working over time. Aim for steady small increases.

12. Be Patient and Persistent

There are unfortunately no shortcuts here – building strong credit takes years of consistently demonstrating responsible behaviors with borrowing and repaying debt. Stay patient and persistent for significant rewards over time. One late slip up can unravel your progress!

With some diligence and smart financial habits practiced over years, gradually improving your credit from fair into the good or ever excellent range is completely achievable. That pays dividends for decades in the form of better loan rates and approvals.

Now let’s tackle some common questions on navigating credit scores:

Frequently Asked Credit Score Questions

How can I check all three FICO credit scores?

The three major consumer credit bureaus (Equifax, Experian and TransUnion) do not provide direct public access to your FICO scores from them. However, many free third party sites like Credit Karma allow you to check reliable FICO estimates updated monthly. For full official FICO scores from all three bureaus though, you need to purchase them at MyFICO.com.

Does checking my own score hurt it?

Nope! Checking your own credit scores whether via truly free resources like Credit Karma or paid FICO access does NOT impact your score at all. Hard inquiries that can temporarily lower scores a few points are only triggered when applying for new lines of credit, not general score checks. So monitor away!

How can I quickly raise my credit score 50 points?

Improving credit scores has no shortcuts – the best practice is allowing your positive history to gradually build your profile over years. However, you can get a nice one time score bump by becoming an authorized user on a spouse or family member’s long positive credit history. Their good standing impacts your file!

What’s the fastest way to improve a bad credit score?

Secured credit cards offer a structured path to rebuild credit by requiring an upfront security deposit that acts as your initial credit limit. Charge small purchases monthly, pay on time and after about a year of positive repayments your score should markedly improve. Gradually grow credit available as your score increases over time.

How long does negative information impact your credit score?

Most negative credit information disappears from your report (and thus score calculation) after 7 years according to the Fair Credit Reporting Act. This includes late payments, collections accounts and even bankruptcies. Still, poor scores can linger if bad habits continue so be vigilant.

How Long Does It Take to Improve Your Credit Score?

You won’t earn an excellent 800+ credit score overnight, but small wins help your number incrementally over time. Allow at least 6-12 months for noticeable score improvements following responsible actions like limiting balances, becoming an authorized user and disputing errors.

Ultimately achieving great credit takes years of persistence, but it’s well worth having access to the best loan rates for decades on major purchases!

Focus on continuing the positive habits outlined here even when tempted with quick fix credit schemes – slow and steady responsible borrowing is the only proven path to victory. You’ve got this!